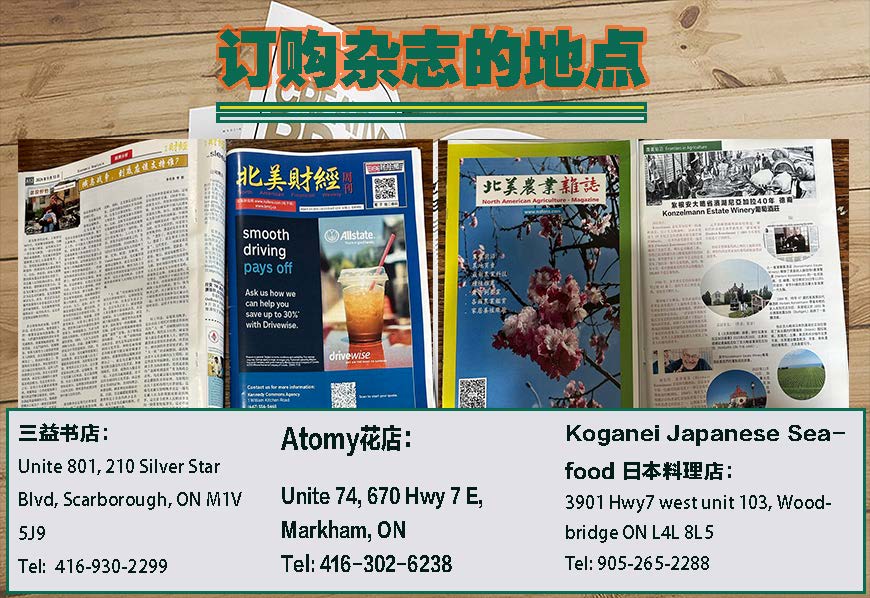

On the fourth floor of a harborside mall on Grand Cayman, not far from touristy scuba-diving

outlets and a jerk-chicken shack, is the offshored home of ride-hailing company DiDi Global Inc.,

one of China’s biggest technology firms. A few doors down are the internet companies Baidu

Inc. and Meituan; Alibaba Group Holding Ltd. is registered at a P.O. box up the street, right

across from Singh’s Roti Shop & Bar.

relates to The China Model: What the Country’s Tech Crackdown Is Really About

Featured in Bloomberg Businessweek, Aug. 2, 2021. Subscribe now.IMAGE: 731

The Caribbean footholds, essentially leased mailing addresses, have no operational value but

have made it easier for Chinese unicorns to attract European and American investors. They’ve

been a bridge between East and West, a sunny symbol of the freewheeling capitalism tolerated

by the Chinese Communist Party (CCP) as the cost of allowing its homegrown juggernauts to

compete with their U.S. counterparts. DiDi’s presence there was needed for it to go public on

the New York Stock Exchange on June 30. Chinese companies saw multiple benefits to gaining

access to the U.S. When DiDi opened a research campus in California in 2017, founder and

Chief Executive Officer Cheng Wei gushed about the company’s “new home … alongside the

greatest technology companies in the world.” Together, they were embarking on a “great

journey.”

But this journey started veering off course in October when Alibaba co-founder Jack Ma, one of

the country’s most visible billionaires, blasted Chinese regulators for stifling innovation.

President Xi Jinping’s government responded by squashing Ma’s plan to take Alibaba’s fintech

offshoot, Ant Group Co., public and initiating an antitrust case against Alibaba. Ma disappeared

from public view, his fortune dwindled, and murmurs began about a broader realignment in the

relationship between China’s government and its biggest companies.

DiDi’s turn came on July 2, just days after its $4.4 billion initial public offering in the U.S.

Regulators ordered a security review, then demanded mobile stores remove DiDi’s apps. “Just

because you are a highly successful tech company does not mean you are above the CCP,”

says Michael Witt, a senior affiliate professor of strategy and international business at Insead in

Singapore. “Ant Group and Jack Ma found that out for themselves last year, and it is surprising

DiDi did not get the message.”

Later in the month, the Chinese government announced a sweeping new regulatory framework

for the online education industry, which it said had been “hijacked by capital,” then said online

food platforms must ensure workers make at least the local minimum income. This gutted share

prices of delivery giant Meituan, which was already facing an investigation into alleged

monopolistic behavior. In separate statements in recent months, Alibaba, Didi, and Meituan

have said they’d cooperate with authorities and work to enhance their compliance systems.

The government’s clampdown signals a new era of harsher oversight that companies won’t be

able to avoid by registering in the Caymans or hiring in California. The world’s two largest

economies seem headed down different paths as they grapple with the sprawling power that

private tech companies have amassed. The authoritarian tinge is a risky pivot to some in and

around the Chinese tech industry—and others see a chance for the country to gain an edge

against its main geopolitical rival. “China is actually taking the lead in setting some boundaries

around the power of Big Tech,” says Thomas Tsao, co-founder of Gobi Partners, a venture

capital firm based in Shanghai. “People are missing the bigger picture. They’re trying a new

model.”

Since the late 1990s, China has emulated Silicon Valley’s approach to innovation. Aided by

Western capital and a generation of Elon Musk-like entrepreneurs—many educated

overseas—the country saw Chinese versions of EBay and Amazon (Alibaba), AOL and

Facebook (Tencent), and Google (Baidu) rocket to success while the government took a

permissive approach to their behavior and largely protected them from U.S. competitors. At first,

Chinese companies replicated services that were unavailable in or not tailored to the country,

but they’ve long ceased to be mere copycats of Valley rivals and now frequently outmaneuver

the global competition. So-called super apps, including Tencent Holdings Ltd.’s WeChat and

Alibaba’s Alipay, also created by Ma and team, handle everything from on-demand

transportation to food delivery to paying utility bills—there’s nothing comparable in the U.S.

These days, Apple, Facebook, and Snapchat are racing to mimic features of these and other

Chinese apps, instead of the other way around.

Just as in the U.S., unfettered growth led to increasingly powerful tech companies and CEOs

who, operating with surprising independence, weren’t afraid to flex their power. China’s biggest

tech companies periodically forced smaller competitors to integrate with their platforms or

pressured them to sell out. Ma and other titans became cultural rock stars. He even started

dressing like a rock star at raucous Alibaba events, complete with a mohawk wig and leather

jacket and guitar, and became vocal about societal issues.

Some see the crackdown on Alibaba and DiDi—along with actions against dozens of other tech

companies—as long overdue. Andy Tian, who led Google China’s mobile strategy in the 2000s

and is now CEO at Beijing social media startup Asian Innovations Group, says it will be “positive

for innovation” and “competition in China will be fiercer than in the U.S.,” because smaller

companies will benefit from policies that rein in the largest competitors.

Angela Zhang, director of Hong Kong University’s Centre for Chinese Law and the author of

Chinese Antitrust Exceptionalism, says the intervention will reshape the tech industry in China

faster than it could happen elsewhere. “The case against Alibaba took the Chinese antitrust

authority only four months to complete, whereas it will take years for U.S. and EU regulators to

go after tech firms such as Facebook, Google, and Amazon, who are ready to fight tooth and

nail,” she says.

Lillian Li, founder of the newsletter Chinese Characteristics, deems the disruption “a rebalancing

of the dynamics, redrawing the boundaries. I don’t think the Chinese government is out there to

destroy tech giants.” After decades of an anything-goes ethos, she says, China wanted to

remind its tech industry “what they can do and can’t do.”

If China is abandoning the Silicon Valley model, what will it replace it with? Insiders suggest it

will be less founder-driven and more China-centric. U.S. antitrust action often focuses on

strengthening consumer protections, but China’s crackdown is ultimately geared toward

protecting government policy. Alicia García-Herrero, a top economist in Hong Kong at

investment bank Natixis, notes that neither Huawei nor ZTE, which together have a lock on the

Chinese telecom networking market, have been targeted so far, likely because they maintain

closer ties to government officials. “Full alignment with China’s leadership is a must to operate in

China,” she says.

President Xi’s government has outlined sectors it wants to prioritize, including semiconductors

and artificial intelligence. Xi has called the data its tech industry collects “an essential and

strategic resource” and has been pushing to tap into it for years. Following a 2015 mandate,

cities from Guiyang to Shanghai have set up data exchanges that facilitate the transfer of

anonymized information between corporations. This could lead to a nationalized data-sharing

system that serves as a kind of digital public infrastructure, putting a massive trove of data into

the central government’s hands.

The danger with this approach is that it could have a chilling effect on innovation. As one

Chinese unicorn founder puts it, this new China tech model would “help hold back some over

creative ideas.” Although this was meant as approval, it also can be read as a scarily restrictive

view of innovation. The war for control over data could also threaten the Cayman Islands’ status

as a bridge between the superpowers. William Kirby, a Harvard professor who specializes in

Chinese business studies, notes that Washington has passed legislation that threatens to delist

the stocks of Chinese companies that don’t submit documentation for audits, potentially

exposing the data China wants to keep for itself. China has already signaled it will make it

harder for Chinese companies to list on U.S. stock markets, limiting their ability to grow and

raise capital outside Asia. “All this is a lose-lose proposition,” Kirby says.

Source: Bloomberg Businesswee