Author: Esther Carenza

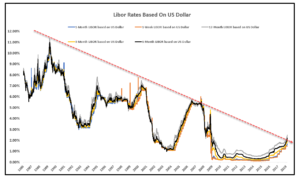

COVID-19 has the stage at present, but Brexit will be ushering in a replacement for the fulcrum of the global financial system, The London Interbank resulting interest rate (LIBOR) or more officially Intercontinental Exchange LIBOR (ICE LIBOR), with the Sterling Overnight Indexed Average (SONIA), which was recommended by Working Group on the Sterling Risk-Free Reference Rates (RFRWG) on April 2017. There are numerous challenges related to the prospective LIBOR transition at the end of 2021 with one of the most largest being the impact of the prospective transition on outstanding financings and other contracts, legacy instruments.

Widespread usage of the formerly known British Bankers Association LIBOR (BBA LIBOR), but now the ICE Benchmark Administration (IBA) came into being from the 1970s as the reference rate for transactions in offshore Eurodollar markets and is not the same as the Bank of England rate. LIBOR, the benchmark, is the forward looking term reference rate major banks and other financial institutions on the London market borrow from one another, which can have a big impact on ordinary borrowers. Based on five currencies, the US dollar, Euro, British pound, Japanese Yen, and Swiss franc and serves seven different maturities – overnight/spot next, one week, and one, two, three, six and twelve months with total number of 35 different LIBOR rates calculated and reported each business day.

In the past, LIBOR was based on the amount the major banks around the world would charge other depository institutions for a short term loan. The group removed the highest and lowest numbers and computed an average from the remaining figures known as the trimmed average.

Since the beginning, LIBOR has been the basis for consumer loans in numerous countries around the world. The interest on credit cards, car loans and adjustable rate mortgages will increase or decrease with changes to the interbank rate. Its movement is critical in determining the ease of borrowing amongst banks, companies and consumers.

More complex derivative products, small and medium-sized businesses, partnerships and sole traders are affected besides the customer products.

Complex Derivative Products

The complex derivative products include standard interbank; commercial area; and hybrid products.

Standard Interbank Products

Within the standard interbank products, we are talking about forward rate agreements; interest rate futures; interest rate swaps; swaptions; overnight indexed swaps; and interest rate options, interest rate cap and floor.

Forward Rate Agreements

Forward rate agreements (FRA) are an over-the-counter agreement to pay or receive the difference between a predetermined interest rate and the interest rate prevailing at a particular future date (referred to the reference rate) on a bond and not a loan between two parties, generally between a party and a bank, who desire the protection against future movements in interest rates. Often, the FRA is settled in cash by way of a cash payment at the commencement of the forward period.

FRAs can either be long or short. In both, there is a right and obligation, however in a long, there is an option to buy whereas in a short, there is the option to lend.

Example 1 – Long Forward Agreement

3 x 6 FRA

The FRA at say for 6 percent for the notional amount of $1 million. The notional amount is not exchanged, however it is a cash amount based on the rate differentials and the notional value of the actual contract. In say a 3 by 6 long FRA, the 3 represents three months or 90 days and is the first term and maturity date of the agreement. The loan is for three months or 90 days. The 6 months or 180 days represents the second term.

In the FRA, an individual can borrow at 6 percent with a benefit if the interest rate increases because he/she can borrow at a lesser rate than in the market.

In the case with LIBOR, after 90 days, the loan starts and the individual receives 6 percent at an annual rate. The 90 day LIBOR turns out to be 7 percent/annual rate. Therefore, the profit is 1 percent. As a rule of thumb, there is no compound interest rate with LIBOR.

One then calculates the profit in the following way:

Convert the $1 m notional value by multiplying 1 percent of the notional value to receive $10,000 profit. But, this amount is for an entire year and not the designated period of 90 days and so it is adjusted by multiplying $10,000 by 90 and dividing it by 360 business days to receive a profit of $2,500. Short term interest rates in the U.S., Europe, and Japan use 360 business days as opposed to England, Australia, New Zealand, Hong Kong and India who use 365 business days.

Example 2 – Short Forward Agreement

1 x 7 FRA

Now in a 1 by 7 short FRA at say for 8 percent with the notional amount of $10 million, the 1 represents 1 month or 30 days, first term and maturity date.

In a short FRA, the term is 7 minus 1 to receive 6 months or 180 days.

If there are the following rates offered:

1. After 30 days, 210 day LIBOR – 7.5 percent

2. After 30 days, 180 day LIBOR – 7.0 percent

3. After 180 days, 30 day LIBOR – 6.0 percent

The first and third rates offered are irrelevant, but the second one applies.

The short FRA matures in 30 days. The loan starts for 180 days.

The lending rate is 8 percent and the market one is 7 percent. Therefore, the benefit is 1 percent. With the notional amount of $10 million, one multiplies 1 percent to get $100,000. The $100,000 is multiplied by the number of days of the loan taken, which in this case is 180 days and it is divided by 360 business days to get $50,000. The final step is in taking the present value (PV) of the $50,000, which is $48,309. The PV is the value of an amount of money today and not in the future.

—( 1 )