Xiaoming Guo 郭晓明

Today, “de-risking” has become the biggest talking point in the foreign economic policies of U.S. allies. The United States has experienced backfire from its decoupling with China so it rename the decoupling to de-risking. The sanctions against China for the US allies have become sanctions against themselves. So there is an expedient measure of “de-risking”: that is, the decoupling sanctions are still the same as before, although it is not satisfactory, it must be done as much as possible regardless. This is the essence of the “de-risking” jargon in geopolitics. But why use the term “de-risking”? This is the need for manipulating public opinion. It is necessary to rationalize the foreign policy of choosing sides in geopolitics, to whitewash the failed policy of containing China, and to cover up mistakes. “De-risking” is most vividly reflected in the harm of European sanctions on Russia to the European economy, but it is still a “politically correct” choice.

“De-risking” is a term for investment strategies in the financial world. De-risking is all about high returns and avoiding risks. But risks exist objectively and are difficult to predict. Therefore, the first way to reduce risks is to diversify investment so to diversify risks. Dispersing risks is like the sealed compartments of a ship. If one compartment leaks, the other compartments remain intact. Therefore, it is possible to avoid shipwrecks caused by leaks in one or two compartments. Diversification of risk, as the saying goes, means not putting all your eggs in one basket. For investors, it is not to invest all assets in a blue chip stock, especially not to bet all assets in a start-up company. Countries with a high degree of foreign economic dependence, should not completely rely on one country but should establish trade relations with as many countries and regions as possible.

The Canadian economy has a high degree of international exposure. Its exports account for about one-third of its GDP. International trade relations are of vital importance to the Canadian economy, which requires de-risking and risk management. Decentralization of foreign trade has always been the mantra of Canadian politicians, and it is the established policy of the Canadian government’s long-term foreign policy.

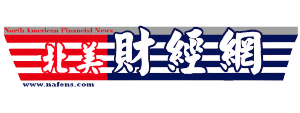

Three-quarters of Canada’s export is destinated to the United States. This is virtually putting all the eggs of Canada’s foreign trade into one basket of the United States. This has caused significant harm to the Canadian economy. For example, an increase in U.S. import tariffs could do significant harm to the Canadian economy. Before the Meng Wanzhou case, Canada’s diversification and de-risking both meant reducing its dependence on the US economy, which is a self-evident basic common sense in economics. However, after the Meng Wanzhou case in 2018, risk diversification ceased to be an economic term and became an excuse to decouple China. After the Meng Wanzhou case, the United States breached the North American Free Trade Agreement, arbitrarily increased tariffs on Canadian softwoods and aluminum, and signed the US-Mexico Free Trade Agreement with Mexico, which was then expanded into the US-Mexico-Canada Free Trade Agreement, which violated Canada’s sovereignty, restricting Canada’s foreign trade policy, and essentially blocking the way for Canada to negotiate free trade with China.

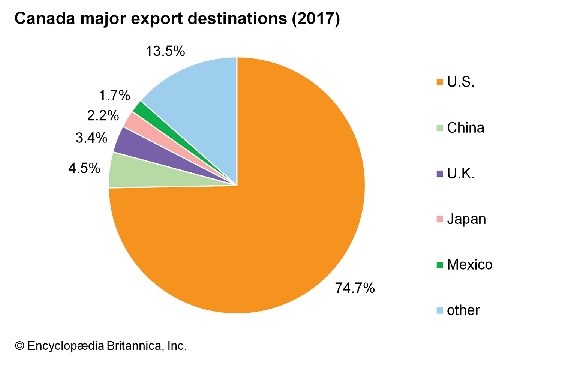

In particular, Canadian crude oil exports are basically in one single market of the United States. This has caused Canadian crude oil exports to lose their negotiation power. The price is completely dictated by the United States. The price of Canadian exported oil is much lower than the international market price. The price difference causes Canada to lose $50 million a day. In 2018, the price difference of Canadian oil exports exceeded $13 billion. Since the shale oil revolution, the United States has become a net oil exporter. In the international oil market, Canada and the United States are competitors. It is unwise to limit the oil export market to only one competitor country, and it is a betrayal of national interests. Canada is a natural gas exporting country. Since the outbreak of the Ukrainian war, Europe urgently needs to import a large amount of liquefied natural gas, but Canada does not have the infrastructure to export natural gas to Europe. The pipeline from Canada to the Atlantic is the pipeline of the United States, which completely controls Canadian export channels.

Alberta’s oil and gas pipelines that supply Ontario pass through the United States and are completely controlled by the United States. This pipeline is about to reach Quebec City. It does not go directly to the sea from Quebec but turns to the United States, and reaches Atlantic at Portland, Maine. This is why Canada’s LNG cannot be exported to Europe. The United States controls Canada’s resources and does not allow it to enter the international market.

Canada’s ban on the use of Huawei equipment and China’s investment in lithium mines, etc., all reduce economic ties between Canada and China. They are all decoupling policies that make Canada’s economy more dependent on the United States. This is a counterfeit strategy by the United States, which has strengthened its control over Canada’s resources and economy on the grounds of “common values” and “democracy against authoritarianism.” It is anti-China in name, but in essence, Washington fully dominates Canada’s political and economic normalcy, making Canada a vassal of the United States.

According to the theory of capital market line, the optimal solution of an investment portfolio is the market portfolio. What is a market line combination? That is, invest in each asset according to the proportion of various assets in the market. Of course, there are tens of thousands of listed companies, and it is unrealistic to buy the stocks of each company, so there are index funds. An index fund is a combination of investment assets according to the capital market line theory. For example, if you invest in 30 companies counted by the Dow Jones Index, you can buy stocks according to the market capitalization ratio of these 30 companies. The philosophy of this theory is very simple, that is, the economy is always growing. During economic growth, some companies go bankrupt and some companies get rich. If you buy all types of stocks in the market in proportion, then the asset portfolio will increase in value along with economic growth.

According to the national strategy of the capital market line theory, foreign economic dependence should be organized according to the GDP ratio of each country. For example, the proportion of Canada’s exports to various countries should be distributed according to the proportion of each country’s GDP in the global economy. For example, the GDP of the United States accounts for 16% of the global economy, and the share of Canada’s exports to the United States should be around 16%, not 75%.

For example, China and the United States each account for 16% of the global economy, so Canada’s de-risking strategy or diversification strategy is to reduce the exports to the United States from 75% of its total to 16% and increase exports to China from 4.5% to 16%. Considering that the United States and Canada are neighboring countries, the export value can be slightly increased, but increasing to 75% is too outrageous. Considering the risk of the United States breaching agreements at will and unilaterally increasing tariffs, it is also reasonable to reduce the share of exports to the United States to 16%. This is just a national de-risking strategy with GDP share as a parameter of the capital market line model.

If we take the proportion of each country’s contribution to global economic growth as the parameter of the capital market line model to formulate a country’s foreign trade risk management policy, then Canada should reduce its exports to the United States from 75% to 18%, and increase its exports to China from 4.5% to 38%, in order to drive the Canadian economic growth and diversify risks.

The Canadian economy and the U.S. economy are competitive economies: Canada exports oil and the U.S. is also a net oil exporter. Canada exports agricultural products, and the United States is also an exporter of agricultural products. Canada exports high technology, and the United States exports high technology. The Canadian economy and the Chinese economy are complementary economies. Economic activities are activities in which resources, labor, and capital are combined to create wealth. China has a large population but relatively few resources, while Canada is just the opposite, with a small population but rich resources. Canada is a developed country and China is a developing country. The strengthening of the relationship between the Canadian economy and the Chinese economy is an important economic growth point and one of the important solutions to the high government debt and inflation in Canada. To fall with the United States? Or to grow with China? This is the question the Canadian government must answer. Canada-China friendship is a major national interest of Canada.