北美經濟

安省将斥资 10 亿美元更新尼亚加拉地区的水利发电站

加拿大新闻社 2024 年 4 月 16 日星期二 10:38AM EDT 安大略省将斥资 10 亿...

苏圣玛丽市和阿尔戈马钢铁公司重新启动大型港口开发投标

上周市政厅批准了一项年薪 112,000 美元的新工作,这标志着苏特郡曾经最热门的就业创造前景悄然重...

未根据人口变化调整 GDP 增长——衡量加拿大经济进步的误导性指标

— 发表于 2024 年 4 月 11 日 加拿大国内生产总值(GDP)的增长一直是记者、分析师和政...

安大略省的垃圾填埋场空间可能会在九年内耗尽。然后呢?

安大略省三分之二的垃圾是由工业、企业和机构制造的。他们很容易倾倒、焚烧和出口,而不是减少、再利用和回...

矿产热潮和招聘危机:加拿大矿业的“肮脏”形象吓跑了新员工

镐和煤尘并没有让新一代人从事采矿工作。该行业能否恢复声誉并采取行动来满足关键矿物的需求? 弗朗西斯卡...

巴拉德燃料电池财富因创纪录的巴士交易和美国超级工厂融资而增加

氢燃料汽车 2024 年 4 月 5 日 尼古拉斯·索基奇 欧洲签订 1,000 台燃料电池发动机协...

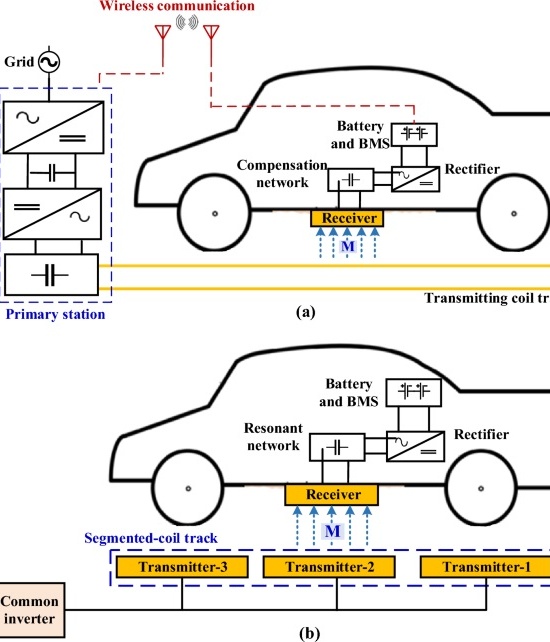

InductEV 将无线充电的成功扩展到加拿大

2024 年 4 月 8 日 感应电动车 交通机构依靠 InductEV 可靠的无线机会充电来实现关...

加拿大自营职业陷入困境所造成的巨大经济影响

自营职业的下降意味着小企业和创业精神的下降 与我们垂死挣扎的实际人均国内生产总值表现不同,大流行的结...

旅游机构表示,返回的游轮将有助于传播财富

尼皮冈——苏必利尔湖北岸的社区将再次欢迎来自世界各地的游客。 在苏必利尔国家旅游组织的组织下,来自 ...

中國經濟

2023胡润北美U30创业先锋大会暨创业之夜完美谢幕

2023年11月26日,由加拿大青商俱乐部和胡润百富联合主办的胡润北美U30创业先锋大会在加拿大万锦...

中国科技副部长呼吁在英国全球人工智能峰会上实现“平等权利”

尽管中国和西方之间存在持续的技术脱钩,但双方正在趋同,讨论失控人工智能可能对人类构成的威胁。中国科技...

美国对中国的经济战

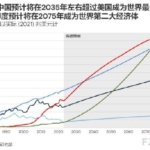

作者:杰弗里·D·萨克斯 2023 年 8 月 22 日 中国经济正在放缓。目前的预测显示,2023...

拒绝正视:对全球秩序视而不见

约翰·奎里佩尔 2023 年 8 月 24 日 西方主导全球秩序的公认规范现已结束。对于西方人来说,...

一文读懂2023年巴菲特股东大会:投资机会来自别人“做蠢事” 未来或增持西方石油 卖掉苹果股票很愚蠢

当地时间5月6日,伯克希尔哈撒韦(491840, 2300.00, 0.47%)9...

6万字完整版!巴菲特股东大会实录

文章来源: 腾讯财经 划重点 1.巴菲特:马斯克是一个非常出色的企业家,他有很多的梦想,喜欢去完成一...

中国必将率先实现智能社会

Xiaoming Guo 郭晓明 马克思理论认为,上层建筑要和经济基础相适应,才能让经...

地产二代, 造车有点悬

(转载华尔街见闻)(编辑:徐旭祥) 在大批新势力车企持续亏损、销量滑坡之时,一个名不见经传的车企拿到...

中国发展模式能延续吗

Xiaoming Guo 郭晓明 上世纪80年代末90年代初,世界发生了重大变化,冷战结束了,一个超...

ChatGPT可能马上取代你!这是它能做的十个工作

(转载华尔街见闻。编辑:徐旭祥) ChatGPT可能马上取代你。金融、法律、传媒、计算机等行业首当其...

生活百科

矿产热潮和招聘危机:加拿大矿业的“肮脏”形象吓跑了新员工

镐和煤尘并没有让新一代人从事采矿工作。该行业能否恢复声誉并采取行动来满足关键矿物的需求? 弗朗西斯卡...

乔安娜·巴伦:最高法院确认《宪章》适用于原住民政府——除非它不适用

法院的裁决几乎肯定对土著妇女来说是个坏消息 乔安娜·巴伦|发表于2024 年 4 月 3 日 当原住...

谁有资格投票才不是外国干预选举?

Xiaoming Guo 郭晓明 2024年4月2日“外国干预听证会”上,董晗鹏的2019年党内提名...

谨防加拿大外国干涉听证会破坏加拿大民主社会

Xiaoming Guo 郭晓明 2024年3月28日,好几家加拿大媒体报道了国会重启外国干涉听证,...

百年沧桑:伦敦洪门几多年?

Xiaoming Guo 郭晓明 2023年9月17日,加拿大洪门民治党伦敦分部举办了...

生意对机械承包商及其工人有利

桑德贝的承包商以及管道工和管道安装工工会表示,该地区的经济前景看起来不错 加里·林内 雷湾——对于雷...

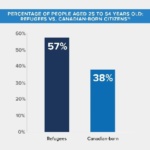

安大略省西北部劳动力规划委员会表示,“工作岗位很多,但没有人”

随着人口老龄化,西北地区劳动年龄的北方人有很多机会 奥斯汀·坎贝尔 尼皮冈——你可能听过你认识的人或...

联邦政府采取长期寻求的举措,使移民试点永久化

移民部长马克·米勒将该计划描述为支持其所在社区的“经济移民” 泰勒·克拉克 2024 年 3 月 7...

安大略省准备成为火环地区的社区建设者

PDAC 周期间,该省加倍加强远北道路和基础设施建设 伊恩·罗斯 安大略省政府准备为那些已经参与火环...

限制外国劳动力可能会使小企业面临的人员配置挑战更加严峻

加拿大独立企业联合会呼吁在未来变化之前进行磋商 多伦多 — 2024 年 2 月 28 日:加拿大独...

都市尋寶

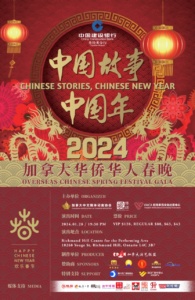

2024“中国故事中国年”加拿大华侨华人春晚将于1月28日上演

由中国建设银行多伦多分行冠名赞助,加拿大中文媒体记者协会、加拿大视传媒、旺市多元文化中心合力打造的第六届 “中 … 2024“中国故事中国年”加拿大华侨华人春晚将于1月28日上演 查看全...

婉莹然 龙珠俪 “慧之灵”助飞翔

——专访多伦多职业规划中心 创始人和资深 顾问 CATHLEEN 暨 7·23 “慧之灵”女性 成长俱乐部 V … 婉莹然 龙珠俪 “慧之灵”助飞翔 查看全文 »

多伦多万人狂欢舞

多伦多万人狂欢舞 红枫影视 Toronto Ten Thousand People Carnival Danc … 多伦多万人狂欢舞 查看全文 »

多伦多保皇会旧址

Xiaoming Guo 郭晓明 要找老唐人街剩下的遗迹,得先聊聊洪门与保皇会。 洪门有各式各样 … 多伦多保皇会旧址 查看全文 »

视频报道

揭开西海岸电动大卡车的未来

最重的柴油半挂车也是最脏的。泰坦货运系统公司选择了电动车道,并表示它正在获得回报。 彼得·费尔利 今日The … 揭开西海岸电动大卡车的未来 查看全文 »

USC/EJP “2024多伦多青少年冰上春晚”圆满举行

(加拿大多伦多讯 摄影视频:滕忠勤)伴随着开场大鼓“中国范儿”龙腾虎跃的旋律,由加中体育文化交流中心 … USC/EJP “2024多伦多青少年冰上春晚”圆满举行 查看全文 &...

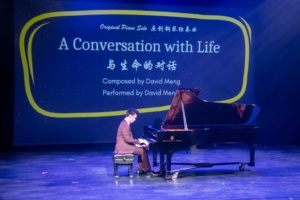

浅奏低吟,天籁飞声,风舞翩翩,流光溢彩 –《与生命的对话 David Meng原创作品音乐会》圆满落幕

(本网滕记报道) 由加拿大威笑声乐(WeSing Canada)主办,加拿大Equiton 冠名赞助的青年作曲 … 浅奏低吟,天籁飞声,风舞翩翩,流光溢彩 –《与生命的对话 ...

2024“中国故事中国年”加拿大华侨华人春晚将于1月28日上演

由中国建设银行多伦多分行冠名赞助,加拿大中文媒体记者协会、加拿大视传媒、旺市多元文化中心合力打造的第六届 “中 … 2024“中国故事中国年”加拿大华侨华人春晚将于1月28日上演 查看全...

ENGLISH CHANNEL

Open Letter to the Public Inquiry into Foreign Interference from members of the Chinese Canadian community

Respect the Democratic Rights of Chinese Canadians and … Open Letter to the Public Inquiry in...

Canadian Chinese women attended the 68th United Nations Conference on Women (11-22 March)

Gender equality drives female creativity and equal oppo … Canadian Chinese women attended the...

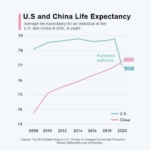

The US has to improve its ties with China eventually

Xiaoming Guo 郭晓明 Q: Do you think the U.S. and Ch … The US has to improve its ties with...

The US national security dilemma

Xiaoming Guo 郭晓明 Q: How should the US handle the bounda … The US national security dilemma 查看...

What’s the consequence of the US trade war and tech war against China?

Xiaoming Guo 郭晓明 Q: What’s the consequence of the … What’s the consequence of the...

How could a Chinese economic collapse happen? How would it affect the US?

Xiaoming Guo 郭晓明 Q: How could a Chinese economic collap … How could a Chinese economic collap...

Democracy & the principle of equal rights and responsibility

Xiaoming Guo The principle of parity of powers and resp … Democracy & the principle of eq...

Why I support Stephen Harper

Xiaoming Guo 郭晓明 I support Stephen Harper because his g … Why I support Stephen Harper 查看全文 &...

All countries should be allies on climate change

Xiaoming Guo 郭晓明 The columnist Brian Lilley wrot … All countries should be allies on c...

The left is pro-immigration, the right is anti-immigration. Who is right?

Xiaoming Guo 郭晓明 Recently, the issue of refugee … The left is pro-immigration, the rig...

广告部

电话:416-779-5688

电子邮件:mynafens@gmail.com

-

EEC Debate 2024春假访藤团--蜕变之旅点燃自驱之火 夏季亲子游学团6月28号将再次起航

-

安省将斥资 10 亿美元更新尼亚加拉地区的水利发电站

-

苏圣玛丽市和阿尔戈马钢铁公司重新启动大型港口开发投标

-

未根据人口变化调整 GDP 增长——衡量加拿大经济进步的误导性指标

-

安大略省的垃圾填埋场空间可能会在九年内耗尽。然后呢?

-

矿产热潮和招聘危机:加拿大矿业的“肮脏”形象吓跑了新员工

-

国际金融投资论坛在多伦多希尔顿大酒店顺利举行

-

巴拉德燃料电池财富因创纪录的巴士交易和美国超级工厂融资而增加

-

InductEV 将无线充电的成功扩展到加拿大

-

全球创新需要全球孵化

-

加拿大自营职业陷入困境所造成的巨大经济影响

-

4月13日多伦多,「聆听东方2024」合唱专场音乐会, 馨声爱乐合唱团主办

-

圣劳伦斯海道

-

旅游机构表示,返回的游轮将有助于传播财富

-

省政府为萨德伯里超额完成住房目标提供 152 万加元

-

大规模木结构建筑达到新高度

-

Electra 为 Temiskaming 炼油厂签署钴供应协议

-

安省政府再支持矿业创新基金三年

-

北方学院与 Interfor 合作缩小技术行业差距

-

“加拿大大萧条”又回来了

-

Stantec帮助蒂明斯镍项目克服联邦评估困难